The insurance industry is poised for significant transformation in 2024, driven by technological advancements, evolving customer expectations, and global challenges. Here are some key trends to watch:

1. Technological Advancements and InsurTech

The integration of advanced technologies such as artificial intelligence (AI), machine learning, and blockchain is revolutionizing the insurance sector. InsurTech companies are leading the charge, offering innovative solutions that enhance efficiency, accuracy, and customer experience. Predictive analytics and AI are being used to assess risks more accurately and streamline claims processing.

Technological advancements are significantly transforming the insurance sector, with InsurTech companies at the forefront of this revolution. The integration of advanced technologies such as artificial intelligence (AI), machine learning, and blockchain is driving this change, offering innovative solutions that enhance efficiency, accuracy, and customer experience.

AI and machine learning are particularly impactful in assessing risks and streamlining claims processing. Predictive analytics, powered by these technologies, allows insurers to evaluate risks with greater precision, leading to more accurate pricing and underwriting. This not only improves the insurer’s ability to manage risk but also ensures that customers receive fairer premiums based on their individual risk profiles.

Blockchain technology is another game-changer, providing a secure and transparent way to handle transactions and data. It enhances trust and reduces fraud by creating immutable records of all transactions. This is particularly beneficial in claims processing, where blockchain can ensure that all parties have access to the same information, reducing disputes and speeding up the resolution process.

InsurTech companies are also leveraging these technologies to improve customer experience. For instance, AI-powered chatbots and virtual assistants provide instant support and personalized advice, making it easier for customers to understand their policies and manage their claims. Additionally, mobile apps and online platforms offer convenient access to insurance services, allowing customers to handle their insurance needs anytime, anywhere.

Overall, the integration of AI, machine learning, and blockchain in the insurance sector is driving significant improvements in efficiency, accuracy, and customer satisfaction, positioning InsurTech companies as key players in the industry’s future.

2. Customer-Centric Business Models

Insurers are shifting towards more customer-centric business models. This involves leveraging data to understand customer needs better and offering personalized products and services. The focus is on improving customer engagement and satisfaction through digital platforms and self-service capabilities.

Insurers are increasingly adopting customer-centric business models to better meet the evolving needs of their clients. This shift involves leveraging data analytics to gain deeper insights into customer preferences and behaviors, enabling insurers to offer more personalized products and services. By understanding individual customer needs, insurers can tailor their offerings to provide greater value and relevance.

A key aspect of this transformation is the use of digital platforms and self-service capabilities. These technologies empower customers to manage their insurance policies more conveniently and efficiently. For instance, digital platforms allow customers to access their policy information, make changes, and file claims online, reducing the need for time-consuming interactions with customer service representatives. Self-service portals and mobile apps provide 24/7 access to insurance services, enhancing customer satisfaction by offering flexibility and convenience.

Moreover, insurers are focusing on improving customer engagement through personalized communication and proactive service. By using data-driven insights, insurers can anticipate customer needs and offer timely advice and support. This proactive approach helps build stronger relationships with customers, fostering loyalty and trust.

The emphasis on customer-centricity also extends to the development of new products and services. Insurers are creating innovative solutions that address specific customer pain points and offer added value. For example, usage-based insurance models, which adjust premiums based on actual usage or behavior, provide a more personalized and fair pricing structure.

Overall, the shift towards customer-centric business models is transforming the insurance industry, leading to improved customer engagement, satisfaction, and loyalty. By leveraging data and digital technologies, insurers are better equipped to meet the diverse needs of their customers in a dynamic and competitive market.

3. Climate Change and Environmental Risks

The increasing frequency and severity of climate-related events are pushing insurers to develop more robust risk management strategies. There is a growing emphasis on sustainability and environmental, social, and governance (ESG) criteria. Insurers are not only reacting to risks but also working proactively to prevent losses and promote sustainable practices.

The increasing frequency and severity of climate-related events are compelling insurers to enhance their risk management strategies. This shift is driven by the need to address the growing impact of climate change on their portfolios and the broader economy. Insurers are now placing a greater emphasis on sustainability and environmental, social, and governance (ESG) criteria to mitigate these risks.

One of the key strategies involves the integration of advanced data analytics and predictive modeling to better understand and anticipate climate-related risks. By leveraging these technologies, insurers can assess the potential impact of extreme weather events and develop more accurate pricing models. This proactive approach helps in reducing the financial losses associated with climate change.

In addition to reacting to risks, insurers are also working proactively to prevent losses and promote sustainable practices. This includes investing in green technologies and supporting initiatives that aim to reduce carbon emissions. For example, some insurers offer incentives for policyholders who adopt environmentally friendly practices, such as using renewable energy sources or implementing energy-efficient measures in their homes and businesses.

Furthermore, insurers are increasingly incorporating ESG criteria into their investment decisions. By prioritizing investments in companies that adhere to high environmental and social standards, insurers can promote sustainability and drive positive change in the market.

Overall, the insurance industry is evolving to address the challenges posed by climate change. By developing robust risk management strategies and promoting sustainable practices, insurers are not only protecting their own interests but also contributing to a more resilient and sustainable future. This proactive stance is essential in navigating the complexities of climate-related risks and ensuring long-term stability.

4. Cybersecurity and Data Privacy

With the rise of digitalization, cybersecurity has become a critical concern. Insurers are investing heavily in cybersecurity measures to protect sensitive customer data and mitigate the risks associated with cyber threats. This includes adopting advanced encryption technologies and implementing stringent data privacy regulations.

With the rise of digitalization, cybersecurity has become a paramount concern for insurers. The increasing reliance on digital platforms and the vast amounts of sensitive customer data they handle make the insurance sector a prime target for cyber threats. To address these risks, insurers are investing heavily in robust cybersecurity measures.

One of the primary strategies involves adopting advanced encryption technologies. Encryption ensures that customer data is securely transmitted and stored, making it difficult for unauthorized parties to access or tamper with the information. This is crucial in protecting personal and financial data from cybercriminals.

In addition to encryption, insurers are implementing stringent data privacy regulations. These regulations are designed to safeguard customer information and ensure compliance with legal standards. By adhering to these regulations, insurers can build trust with their customers, demonstrating their commitment to protecting sensitive data.

Moreover, insurers are enhancing their cybersecurity frameworks by incorporating multi-layered security protocols. This includes the use of firewalls, intrusion detection systems, and regular security audits to identify and address vulnerabilities. By continuously monitoring and updating their security measures, insurers can stay ahead of emerging threats and minimize the risk of data breaches.

Employee training is another critical component of cybersecurity efforts. Insurers are educating their staff on best practices for data protection and cyber hygiene. This helps in preventing human errors that could lead to security breaches.

Overall, the insurance industry is taking significant steps to enhance cybersecurity and data privacy. By investing in advanced technologies and implementing rigorous security protocols, insurers are better equipped to protect customer data and mitigate the risks associated with cyber threats. This proactive approach is essential in maintaining customer trust and ensuring the integrity of digital insurance services.

5. Regulatory Changes

The insurance industry is facing a dynamic regulatory environment. New regulations aimed at protecting consumer interests and ensuring market stability are being introduced. Insurers need to stay agile and adapt to these changes to remain compliant and competitive.

The insurance industry is navigating a dynamic regulatory environment characterized by the introduction of new regulations aimed at protecting consumer interests and ensuring market stability. These regulatory changes are driven by the need to address emerging risks, enhance transparency, and promote fair practices within the industry.

One of the primary objectives of these regulations is to safeguard consumer interests. This includes measures to ensure that insurance products are clearly explained, fairly priced, and accessible to a broad range of consumers. Regulators are also focusing on improving the claims process, making it more efficient and transparent to enhance customer satisfaction.

To remain compliant and competitive, insurers must stay agile and adapt to these regulatory changes. This involves continuously monitoring regulatory developments and updating their policies and procedures accordingly. Insurers are investing in compliance management systems and training programs to ensure that their staff are well-versed in the latest regulatory requirements.

Moreover, regulatory changes often necessitate the adoption of new technologies and practices. For instance, insurers may need to implement advanced data analytics and reporting tools to meet regulatory standards for transparency and accountability. These technologies not only help in compliance but also provide valuable insights that can drive business growth and innovation.

The emphasis on market stability is another critical aspect of the regulatory landscape. Regulators are introducing measures to strengthen the financial resilience of insurers, such as capital adequacy requirements and risk management frameworks. These measures are designed to ensure that insurers can withstand economic shocks and continue to meet their obligations to policyholders.

Overall, the evolving regulatory environment presents both challenges and opportunities for the insurance industry. By staying agile and proactive, insurers can navigate these changes effectively, ensuring compliance while maintaining their competitive edge in the market.

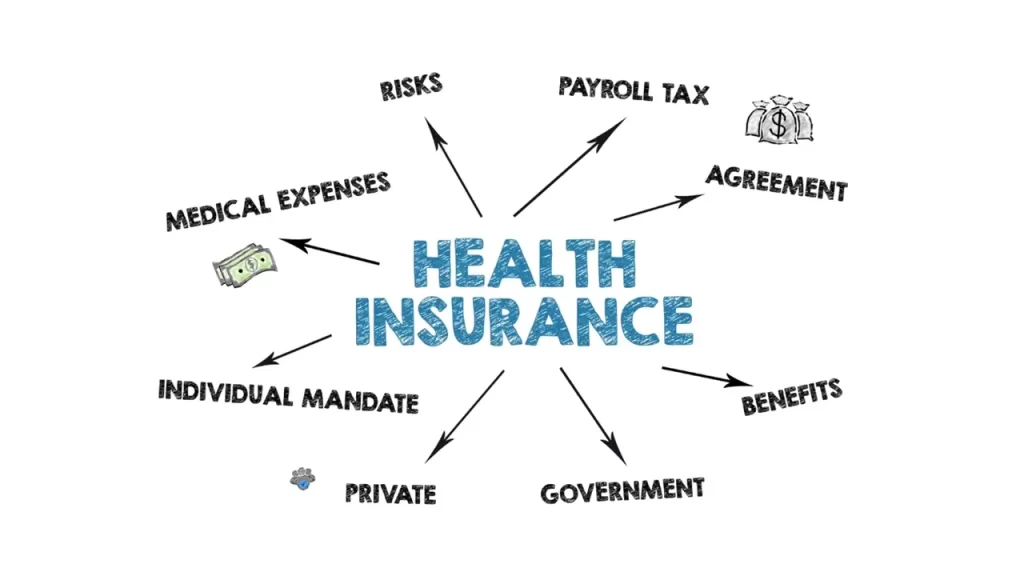

6. Health and Wellbeing Programs

There is a growing trend towards integrating health and wellbeing programs into insurance offerings. Insurers are providing incentives for healthy behaviors and offering products that cater to the holistic wellbeing of their customers. This includes mental health support, wellness programs, and preventive care services.

There is a growing trend in the insurance industry towards integrating health and wellbeing programs into their offerings. Insurers are increasingly recognizing the importance of promoting holistic wellbeing among their customers and are providing incentives for healthy behaviors. These programs are designed to cater to various aspects of health, including physical, mental, and preventive care.

One of the key components of these programs is mental health support. Insurers are offering services such as counseling, therapy, and stress management resources to help customers maintain their mental wellbeing. This focus on mental health is crucial, as it addresses a significant aspect of overall health that has often been overlooked in traditional insurance models.

Wellness programs are another integral part of this trend. These programs encourage healthy lifestyles through activities such as fitness challenges, nutrition guidance, and smoking cessation programs. By participating in these programs, customers can earn rewards or discounts on their premiums, providing a financial incentive to adopt healthier habits.

Preventive care services are also being emphasized. Insurers are offering coverage for regular health screenings, vaccinations, and other preventive measures to help customers detect and address health issues early. This proactive approach not only improves individual health outcomes but also reduces long-term healthcare costs for both insurers and customers.

Overall, the integration of health and wellbeing programs into insurance offerings reflects a shift towards a more customer-centric approach. By promoting holistic wellbeing and incentivizing healthy behaviors, insurers are enhancing the value of their products and fostering a healthier, more engaged customer base. This trend is likely to continue as the benefits of such programs become increasingly evident.

7. Mergers and Acquisitions

The insurance industry is witnessing a wave of mergers and acquisitions, driven by the need for scale, diversification, and technological capabilities. InsurTech companies are often at the center of these deals, as traditional insurers seek to enhance their digital offerings and stay competitive.

The insurance industry is currently experiencing a significant wave of mergers and acquisitions (M&A), driven by the need for scale, diversification, and enhanced technological capabilities. This trend is reshaping the competitive landscape, as companies seek to strengthen their market positions and improve operational efficiencies.

One of the primary motivations behind these M&A activities is the pursuit of scale. Larger entities can benefit from economies of scale, reducing costs and increasing their bargaining power with suppliers and customers. This is particularly important in a highly competitive market where cost efficiency can be a key differentiator.

Diversification is another critical factor driving M&A in the insurance sector. By acquiring or merging with other companies, insurers can expand their product offerings and enter new markets. This diversification helps mitigate risks associated with market volatility and economic downturns, providing a more stable revenue base.

Technological capabilities are also a major focus in recent M&A activities. Traditional insurers are increasingly looking to acquire InsurTech companies to enhance their digital offerings and stay competitive. InsurTech firms bring innovative solutions, such as advanced data analytics, artificial intelligence, and blockchain technology, which can significantly improve customer experience and operational efficiency.

These acquisitions enable traditional insurers to integrate cutting-edge technologies into their existing operations, offering more personalized and efficient services to their customers. Additionally, the infusion of technological expertise helps insurers streamline their processes, reduce fraud, and improve risk management.

Overall, the wave of mergers and acquisitions in the insurance industry is driven by the need for scale, diversification, and technological advancement. By strategically acquiring or merging with other companies, insurers can enhance their competitive edge, adapt to changing market dynamics, and better serve their customers in an increasingly digital world.

8. Economic Factors

Economic conditions, including inflation and interest rates, continue to impact the insurance industry. Insurers are adjusting their pricing strategies and investment portfolios to navigate these challenges. The aftermath of the COVID-19 pandemic also continues to influence market dynamics and consumer behavior.

Economic conditions, such as inflation and interest rates, significantly impact the insurance industry. Insurers are continuously adjusting their pricing strategies and investment portfolios to navigate these challenges effectively. Inflation, for instance, can lead to higher claims costs as the prices of goods and services increase. To counter this, insurers may need to raise premiums to maintain profitability. However, this must be balanced carefully to avoid losing customers due to higher costs.

Interest rates also play a crucial role in the insurance sector. Low interest rates can reduce the returns on insurers’ investment portfolios, which are essential for covering future claims. In response, insurers might seek alternative investment strategies to achieve better yields, such as investing in higher-risk assets. However, this approach requires careful risk management to avoid potential losses.

The aftermath of the COVID-19 pandemic continues to influence market dynamics and consumer behavior. The pandemic has heightened awareness of health and financial security, leading to increased demand for certain types of insurance, such as health and life insurance. At the same time, economic uncertainty has made consumers more price-sensitive, prompting insurers to offer more flexible and affordable products.

Additionally, the pandemic has accelerated the adoption of digital technologies in the insurance industry. Insurers are leveraging digital platforms to enhance customer engagement and streamline operations, which is crucial in a competitive market.

Overall, economic factors, including inflation, interest rates, and the lingering effects of the COVID-19 pandemic, are shaping the insurance industry’s strategies. Insurers must remain agile and innovative to navigate these challenges and meet the evolving needs of their customers.

9. Human Capital and Workforce Transformation

The insurance workforce is undergoing significant transformation. There is a focus on upskilling employees to handle new technologies and changing customer expectations. Insurers are also adopting flexible work arrangements and enhancing employee engagement to attract and retain talent.

The insurance workforce is experiencing significant transformation, driven by the need to adapt to new technologies and evolving customer expectations. A key focus is on upskilling employees to ensure they are proficient in advanced digital tools and capable of delivering enhanced customer experiences. This includes training in areas such as data analytics, artificial intelligence, and digital customer service platforms.

To attract and retain talent, insurers are adopting flexible work arrangements. The shift towards remote and hybrid work models has become more prevalent, offering employees greater flexibility and work-life balance. This approach not only improves employee satisfaction but also broadens the talent pool by allowing insurers to hire from a more diverse geographic area.

Employee engagement is another critical area of focus. Insurers are implementing strategies to foster a more inclusive and supportive work environment. This includes regular feedback mechanisms, professional development opportunities, and initiatives to promote mental health and wellbeing. By creating a positive workplace culture, insurers aim to boost morale and productivity.

Moreover, the industry is seeing the emergence of new roles and job titles that reflect the changing landscape. Positions such as data scientists, digital transformation specialists, and customer experience managers are becoming increasingly important. These roles are essential for driving innovation and ensuring that insurers can meet the demands of a digital-first market.

Overall, the transformation of the insurance workforce is essential for staying competitive in a rapidly changing industry. By upskilling employees, adopting flexible work arrangements, and enhancing engagement, insurers are better positioned to navigate the challenges and opportunities of the digital age.

10. Innovation in Product Offerings

Insurers are innovating their product offerings to meet the evolving needs of customers. This includes developing new types of coverage, such as cyber insurance, and offering more flexible and customizable policies. The goal is to provide comprehensive protection that aligns with modern lifestyles and risks.

Insurers are actively innovating their product offerings to better meet the evolving needs of customers in today’s dynamic environment. This innovation is driven by the necessity to address modern risks and lifestyles, ensuring that insurance products remain relevant and valuable.

One significant area of innovation is the development of new types of coverage, such as cyber insurance. As cyber threats become more prevalent, there is a growing demand for policies that protect against data breaches, cyberattacks, and other digital risks. Cyber insurance provides businesses and individuals with financial protection and support in the event of a cyber incident, reflecting the increasing importance of digital security.

In addition to new coverage types, insurers are offering more flexible and customizable policies. Traditional one-size-fits-all insurance products are being replaced by options that allow customers to tailor their coverage to their specific needs. This customization can include adjustable coverage limits, modular policy components, and personalized pricing based on individual risk profiles. Such flexibility ensures that customers receive comprehensive protection that aligns with their unique circumstances.

Furthermore, insurers are incorporating innovative features into their products to enhance value and convenience. For example, some policies now include wellness programs, telehealth services, and preventive care options, promoting overall health and wellbeing. Usage-based insurance models, which adjust premiums based on actual usage or behavior, are also gaining popularity, offering fairer pricing and incentivizing safer practices.

Overall, the innovation in product offerings is transforming the insurance industry. By developing new types of coverage and offering flexible, customizable policies, insurers are better equipped to provide comprehensive protection that meets the diverse needs of modern customers. This focus on innovation ensures that insurance remains a vital tool for managing risk in an ever-changing world.

Conclusion

The future of insurance in 2024 is marked by rapid change and innovation. Insurers that embrace these trends and adapt to the evolving landscape will be well-positioned to thrive in this dynamic environment. By leveraging technology, focusing on customer needs, and addressing global challenges, the insurance industry can continue to serve as a vital financial safety net for society.

Feel free to ask if you need more details on any specific trend or have other questions!

Hmm is anyone else having problems with the images on this blog loading? I’m trying to figure out if its a problem on my end or if it’s the blog. Any responses would be greatly appreciated.