Understanding Term Life Insurance

Term life insurance is a type of life insurance policy that provides coverage for a specified period, or “term,” typically ranging from 10 to 30 years. It is designed to offer financial protection to your beneficiaries in the event of your death during the policy term. Here’s a comprehensive look at term life insurance, its benefits, and how it works.

What is Term Life Insurance?

Term life insurance guarantees payment of a stated death benefit to the insured’s beneficiaries if the insured person dies during the specified term. Unlike permanent life insurance policies, term life insurance does not have a savings component. This means it is purely focused on providing a death benefit and does not accumulate cash value over time.

How Term Life Insurance Works

When you purchase a term life insurance policy, you agree to pay regular premiums to the insurance company. In return, the insurer promises to pay a death benefit to your beneficiaries if you pass away during the term of the policy. The premium amount is determined based on factors such as your age, health, lifestyle, and the length and amount of coverage.

If the policy expires before your death, there is no payout. However, many policies offer the option to renew or convert to a permanent policy.

Benefits of Term Life Insurance

- Affordability: Term life insurance is generally more affordable than permanent life insurance because it only provides coverage for a specific period and does not build cash value.

- Simplicity: The straightforward nature of term life insurance makes it easy to understand and manage.

- Flexibility: You can choose the term length that best fits your needs, whether it’s to cover the years until your children are financially independent or until your mortgage is paid off.

Drawbacks of Term Life Insurance

- Temporary Coverage: Coverage is limited to the term of the policy. If you outlive the term, you may need to purchase a new policy at a higher premium due to increased age.

- No Cash Value: Unlike permanent life insurance, term policies do not accumulate cash value that you can borrow against or withdraw.

Choosing the Right Term Life Insurance

When selecting a term life insurance policy, consider the following factors:

- Coverage Amount: Determine how much coverage you need to support your beneficiaries in your absence.

- Term Length: Choose a term that aligns with your financial obligations and goals.

- Premiums: Ensure the premiums fit within your budget while providing adequate coverage.

- Company Reputation: Select a reputable insurance company with strong financial ratings and good customer service.

If you have any more questions or need further assistance with financial planning, feel free to ask!

Types of Term Life Insurance

1. Level Term:

The death benefit remains the same throughout the policy term.

Level term life insurance is a type of term life insurance where both the death benefit and the premium remain constant throughout the policy’s duration. This means that the amount paid out to beneficiaries upon the policyholder’s death does not change, regardless of when the death occurs within the term.

Typically, level term policies are available for fixed periods, such as 10, 15, 20, or 30 years. These policies are designed to provide straightforward and predictable coverage, making them ideal for individuals with specific financial obligations like mortgages, educational expenses, or family support needs.

One of the main advantages of level term life insurance is its predictability. Policyholders know exactly how much their beneficiaries will receive, which helps in planning and budgeting. Additionally, since the premiums remain the same, it simplifies financial planning as there are no unexpected increases in costs.

Level term life insurance is often more affordable in the long run compared to other types of life insurance, especially if purchased when the policyholder is young and healthy. This type of insurance is particularly beneficial for those seeking to lock in a rate and coverage amount based on their current health status.

In summary, level term life insurance offers stable and predictable financial protection for a specified period, ensuring that beneficiaries receive a consistent death benefit, which can be crucial for managing ongoing financial responsibilities.

2. Decreasing Term:

The death benefit decreases over the policy term, often used to cover a mortgage or other debts that decrease over time.

Decreasing term life insurance is a type of term life insurance where the death benefit gradually decreases over the policy’s term. This type of insurance is often used to cover financial obligations that diminish over time, such as a mortgage or other loans.

The primary purpose of decreasing term life insurance is to ensure that the outstanding balance of a debt, like a mortgage, is covered if the policyholder passes away during the term of the policy. As the debt decreases, so does the death benefit, aligning the coverage with the remaining financial obligation.

One of the key features of decreasing term life insurance is that while the death benefit decreases, the premiums typically remain level throughout the policy term. This makes it a cost-effective option for those looking to cover specific debts without paying for more coverage than necessary.

Decreasing term life insurance is particularly beneficial for homeowners who want to ensure their mortgage is paid off in the event of their death, thereby easing the financial burden on their loved ones. It can also be used to cover other types of loans, such as car loans or business loans.

In summary, decreasing term life insurance provides a practical and affordable way to ensure that specific, diminishing financial obligations are covered, offering peace of mind to policyholders and their beneficiaries.

3. Convertible Term:

Allows the policyholder to convert the term policy into a permanent policy without a medical exam.

Convertible term life insurance is a type of term life insurance that allows the policyholder to convert their term policy into a permanent life insurance policy without needing a medical exam. This feature provides flexibility and ensures continued coverage even if the policyholder’s health deteriorates over time.

Typically, convertible term policies come with a predetermined time window during which the conversion can be made. This conversion option can be part of the basic policy or added as a rider. The main advantage is that it allows policyholders to secure long-term coverage without the risk of being denied due to health issues that may have developed since the original policy was issued.

When converting a term policy to a permanent one, the death benefit remains the same, but the premiums will increase to reflect the permanent coverage. Permanent life insurance, such as whole life or universal life, offers lifelong coverage and can accumulate cash value over time. This makes it a valuable option for those who anticipate needing coverage beyond the initial term or who want to build a financial asset through their life insurance policy.

In summary, convertible term life insurance provides a practical solution for those seeking the affordability of term life insurance with the option to extend coverage into a permanent policy without undergoing additional medical exams.

4. Renewable Term:

Offers the option to renew the policy at the end of the term without a medical exam, though premiums may increase based on age at renewal.

Renewable term life insurance is a type of term life insurance that allows the policyholder to renew their coverage at the end of the term without undergoing a new medical exam. This feature provides flexibility and ensures continued coverage even if the policyholder’s health has changed.

When the initial term of the policy expires, the policyholder can renew the policy for another term, typically at a higher premium. The increase in premium is based on the policyholder’s age at the time of renewal. This means that while the coverage can continue, the cost will reflect the increased risk associated with the policyholder’s older age.

Renewable term life insurance is beneficial for those who may need temporary coverage but want the option to extend it without the hassle of re-qualifying medically. It is particularly useful for individuals whose health may have declined, making it difficult to obtain new coverage.

This type of policy is often more affordable initially compared to permanent life insurance, making it an attractive option for those seeking cost-effective coverage with the flexibility to extend it as needed. However, it’s important to consider that the premiums will increase upon renewal, which can become costly over time.

In summary, renewable term life insurance offers a practical solution for maintaining life insurance coverage without the need for additional medical exams, though it comes with the trade-off of higher premiums based on age at renewal.

Would you like to explore more about life insurance options or have any other questions?

Conclusion

Term life insurance is an excellent option for those seeking affordable and straightforward life insurance coverage for a specific period. By understanding the different types of term life insurance and carefully selecting the right policy, you can ensure that your loved ones are financially protected in the event of your untimely death.

What are the pros and cons of term life insurance?

Pros and Cons of Term Life Insurance

Pros:

- Affordability: Term life insurance is generally more affordable than permanent life insurance because it only provides coverage for a specific period and does not build cash value.

- Simplicity: The straightforward nature of term life insurance makes it easy to understand and manage.

- Flexibility: You can choose the term length that best fits your needs, whether it’s to cover the years until your children are financially independent or until your mortgage is paid off.

- High Coverage Amounts: You can often get a higher death benefit for a lower premium compared to permanent life insurance.

Cons:

- Temporary Coverage: Coverage is limited to the term of the policy. If you outlive the term, you may need to purchase a new policy at a higher premium due to increased age.

- No Cash Value: Unlike permanent life insurance, term policies do not accumulate cash value that you can borrow against or withdraw.

- Increasing Premiums: If you choose a renewable term policy, premiums may increase significantly upon renewal.

Explain more about convertible term policies?

Convertible Term Policies

Convertible term life insurance allows you to convert your term policy into a permanent life insurance policy without undergoing a medical exam. Here are some key points:

- Flexibility: You can switch to a permanent policy if your needs change, such as if you want lifelong coverage or to build cash value.

- No Medical Exam: Conversion does not require a new medical exam, which can be beneficial if your health has declined since you first purchased the term policy.

- Higher Premiums: Permanent policies generally have higher premiums than term policies, so your premiums will increase upon conversion.

- Conversion Period: There is usually a specific period during which you can convert your policy, often within the first few years of the term.

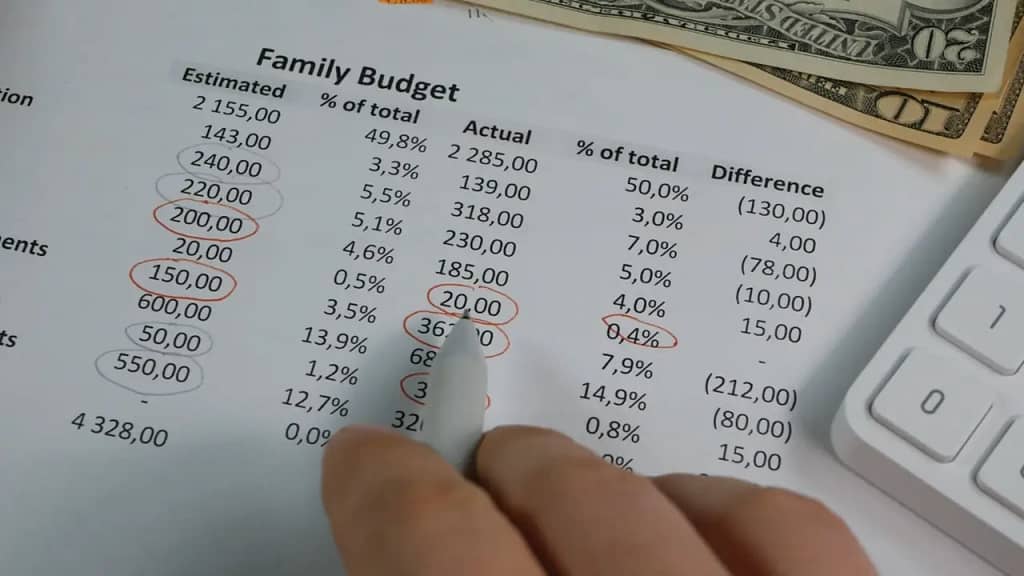

How do you calculate how much coverage you need?

Calculating Coverage Needs

To determine how much coverage you need, consider the following steps:

- Assess Financial Obligations: Calculate your outstanding debts (mortgage, loans, credit cards), future expenses (children’s education, retirement), and daily living expenses for your dependents.

- Income Replacement: Determine how many years of income your family would need to replace if you were no longer there to provide for them.

- Existing Assets: Consider any savings, investments, or other life insurance policies that could help cover expenses.

- Final Expenses: Include costs for funeral and burial expenses.

A common method is the DIME formula:

- Debt: Total of all your debts.

- Income: Multiply your annual income by the number of years you want to provide for your family.

- Mortgage: The amount needed to pay off your mortgage.

- Education: Estimated cost of your children’s education.

For example, if you have $100,000 in debt, want to replace 10 years of a $50,000 annual income, have a $200,000 mortgage, and estimate $100,000 for education, you would need $850,000 in coverage.

Feel free to ask if you need more details or have other questions!

What are the other types of term life insurance?

Other Types of Term Life Insurance

In addition to the common types of term life insurance like level term and decreasing term, here are a few more variations:

- Yearly Renewable Term (YRT): This policy is renewable every year without a medical exam, but premiums increase annually based on age.

- Return of Premium (ROP) Term: This policy refunds the premiums paid if you outlive the term. However, it tends to be more expensive than standard term policies.

- Convertible Term: Allows you to convert your term policy into a permanent policy without a medical exam, providing flexibility if your needs change over time.

How do you choose a reliable insurance company?

Choosing a Reliable Insurance Company

Selecting a reliable insurance company is crucial for ensuring your policy will be honored when needed. Here are some tips:

- Financial Strength: Check the financial ratings of the company from agencies like AM Best, Moody’s, or Standard & Poor’s. A high rating indicates strong financial health.

- Customer Service: Look for reviews and ratings on customer service. J.D. Power ratings can be a good indicator of customer satisfaction.

- Claims Process: Research the company’s claims process and their reputation for paying out claims promptly and fairly.

- Complaint Ratios: Visit your state’s department of insurance website to check the company’s complaint ratios. Lower ratios indicate fewer complaints relative to the number of policies issued.

- Recommendations: Seek recommendations from financial advisors or friends and family who have had positive experiences with their insurers.

Provide an example calculation for coverage needs?

Example Calculation for Coverage Needs

Let’s use the DIME method to calculate coverage needs. Suppose you have the following financial obligations and goals:

- Debt: $50,000 in student loans and credit card debt.

- Income Replacement: You earn $60,000 annually and want to provide for your family for 10 years.

- Mortgage: $200,000 remaining on your mortgage.

- Education: $100,000 estimated for your child’s college education.

Here’s the calculation:

- Debt: $50,000

- Income Replacement: $60,000 x 10 years = $600,000

- Mortgage: $200,000

- Education: $100,000

Total Coverage Needed: $50,000 + $600,000 + $200,000 + $100,000 = $950,000

So, you would need approximately $950,000 in term life insurance coverage to meet these needs.

If you have any more questions or need further assistance, feel free to ask!

What are the common mistakes to avoid when buying term life insurance?

Common Mistakes to Avoid When Buying Term Life Insurance

- Underestimating Coverage Needs: Not calculating enough coverage to meet your family’s financial needs can leave them under-protected.

- Choosing the Wrong Term Length: Selecting a term that is too short may result in needing to buy another policy later at a higher premium.

- Ignoring Health Changes: Failing to disclose health issues can lead to claim denials. Always provide accurate health information.

- Not Comparing Policies: Different insurers offer varying benefits and premiums. Not shopping around can result in higher costs or less favorable terms.

- Delaying Purchase: Waiting too long to buy a policy can result in higher premiums due to age or health changes.

- Overlooking Riders: Riders can provide additional benefits like critical illness coverage. Not considering them might mean missing out on valuable coverage options.

How do you compare premium quotes from different insurers?

Comparing Premium Quotes from Different Insurers

- Use Online Comparison Tools: Websites like Policygenius, NerdWallet, and others allow you to compare quotes from multiple insurers.

- Check Coverage Details: Ensure that the policies you are comparing offer similar coverage amounts and terms.

- Review Riders and Add-ons: Compare the availability and cost of additional riders that may be important to you.

- Consider Financial Strength: Compare the financial ratings of the insurers to ensure they are reliable.

- Look at Customer Reviews: Read reviews and ratings to gauge customer satisfaction and claims handling.

- Consult an Insurance Agent: An independent insurance agent can provide quotes from multiple companies and help you understand the differences.

Explain more about term conversion options?

Term Conversion Options

Term conversion options allow you to convert your term life insurance policy into a permanent life insurance policy, such as whole life or universal life, without undergoing a new medical exam. Here are some key points:

- Flexibility: You can convert your term policy to permanent coverage, providing lifelong protection and the potential to build cash value.

- No Medical Exam: Conversion does not require a new medical exam, which can be beneficial if your health has declined since you first purchased the term policy.

- Conversion Period: There is usually a specific period during which you can convert your policy, often within the first few years of the term.

- Premiums: Permanent policies generally have higher premiums than term policies, so your premiums will increase upon conversion.

- Partial Conversion: Some insurers allow partial conversions, meaning you can convert a portion of your term coverage to permanent coverage.

If you have any more questions or need further assistance, feel free to ask!

What are the benefits of term conversion options?

Benefits of Term Conversion Options

- Flexibility: Allows you to convert your term policy to a permanent policy, such as whole life or universal life, without undergoing a new medical exam.

- Lifelong Coverage: Provides the opportunity to extend your coverage for your entire life, ensuring your beneficiaries are protected no matter when you pass away.

- Cash Value Accumulation: Permanent policies often build cash value over time, which you can borrow against or withdraw.

- Premium Stability: Lock in premiums based on your health at the time of the original term policy, potentially saving money if your health has declined.

- Peace of Mind: Offers the security of knowing you can maintain coverage without the risk of being denied due to health changes.

Thank you for this well-written and informative post. The depth of your analysis is impressive, and your writing style is engaging. I learned a lot from this article and will definitely be referring back to it in the future. Keep up the great work!